I got my first check for service as a juror today. I love that where one would normally find the account holder’s name, it just says “United States Treasury.” Evidently the government goes straight to the source when writing checks. (This somehow reminds me of that classic line from The Princess Bride: “You are the Brute Squad!”)

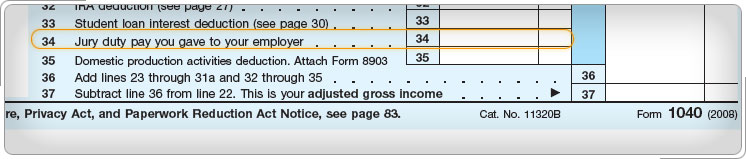

Being the responsible and obsessive adult that I am, I immediately wanted to know the tax implications. Google immediately produced an article titled “Jury Duty Pay Given to Employer” on the IRS website. Many employers ask staff to hand over their jury duty pay in exchange for earning their regular salary while they’re serving as a juror. The article clarifies that this can be deducted on line 34 of the 1040 form, as seen in this graphic from the article:

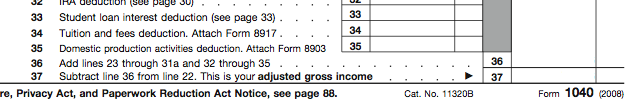

Note in the lower right corner that this is the form for 2008. I happen to have submitted a 1040 form that year, which, of course, I saved. After cropping it and blanking out the amounts (but making no other changes), my copy looks like this:

Either “tuition and fees” and “jury duty pay” are terms we’re now using interchangeably, or we should probably be a little nervous that the IRS doesn’t know what its own forms look like.